The Illusion of Risk... Headbutts On Broken Glass...

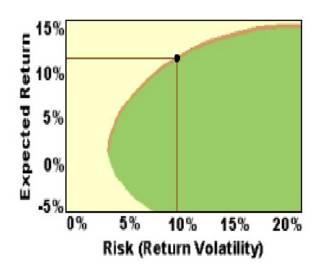

Efficient Frontiers are for Ass-Pirates. The CFA spoke so highly of Sharpe's Ratio, but never once mentioned Sortino's Ratio and the darkside of Las 'Vega', probably because Sortino was Italian. Most Standard Deviations when conducted in the realm of finance are based on an annual period. Generally, as I only write and speak to an Audience wielding Brass Balls, let's lock down on a period of three days, where I generated a 125% return using the highest of leverage(credit card+margin; the rest of course was emotional history). If we are truly in a Fractal environment, those dreamy and nightmarish Tail Ends of the Normal Bell Curve, the standard of Modern Portfolio Theorists, are actually repetitive normal bell curves in themselves, self similarity, if you dissect time period upon time period to infinity. For the Academic Wharton Graduate, this appears as such blasphemy and foolhardy risk. There's a reason why I opted to take the CFA route in opposition to highfalutin cocktail parties... So, the brave travel with me to the desert, and we'll find the river, and it has no more risk than a certificate of deposit. I know who you are within 5 minutes, sometimes a glance, some are types, some are designated... You wage your petty War of Nerves, but you can't crush my kingdom... I've spilled my guts out in the past... been taken advantage of, be careful now, because you know where I come from...

0 Comments:

Post a Comment

<< Home